Need Earthquake Coverage in Florida? You Actually Might.

Earthquake Insurance. You might need it soon in Florida.

While researching details on our homeowners insurance companies, an earthquake coverage option showed up in the mix. As FLINSCO.com expands into various states nationwide, and as climate change continually shifts weather patterns on this fragile globe of ours, the question of whether we have earthquakes in Florida arose.

The findings? The answer is yes – and this happened only a few months ago.

In April 2019, The Miami Herald published an article asking “Are there Earthquakes in Florida?” Technically that is the case.

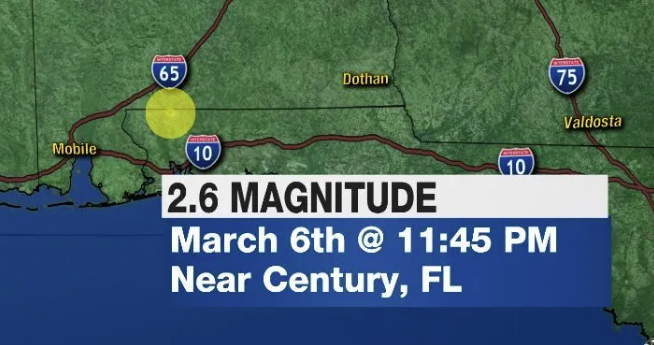

According to WFLA.com, on March 6, 2019, a 2.6 magnitude earthquake was centered 6 miles east of Century, Florida. Five quakes were reported in March throughout Southern Alabama, right near Florida’s north border.

One of those quakes included a 1.8 magnitude, two-mile deep earthquake hit the panhandle right on the Florida-Alabama line. That quake was followed by a four-mile deep earthquake with a magnitude of 2.5 on April 11 in south Alabama. April of 2019 brought a series of nine earthquakes total.

Falk Amelung, Professor of Marine Geosciences at the University of Miami’s Rosenstiel School of Marine and Atmospheric Sciences noted, “This is an area where a couple of decades ago several quakes occurred. So it is possible that these were natural earthquakes.”1

So there may be an increasing need for earthquake insurance in years to come based on this new shift in extreme weather. You thought hurricane season was bad enough.

Prior to 2019, Floridians were given a jolt of 3.7 magnitude off the coast of Daytona in July 2016. However, that quake appeared on the radar due to a man-made explosion testing a Navy vessel, rather than a shift in tectonic plates.

Back in 2006, Gulf Coast residents felt the buzz of a 5.8 magnitude earthquake. Its center was approximately 250 miles west-southwest of Anna Maria Island, Florida. It’s not entirely out of the question to pick up an Earthquake Insurance policy for Florida Homeowners as a result.

You can evaluate your risk for earthquake exposure using a tool created by FEMA.gov.

As a Florida resident, your risk of experiencing earthquake damage will still remain on the low end. At once, it doesn’t hurt to be prepared for erratic weather as tides continue to rise, plates shift, and patterns become less predictable.

Flinsco.com offers personal insurance coverage options for homeowners from carriers like Tapco, who also sell Earthquake policies.

For the most part, we are talking to our friends in states like California, Oklahoma, and other lands located on or near a fault line. The Insurance Information Institute asserts that even if you do not live near a fault line, Earthquake Insurance is becoming a necessary addition to your home insurance package.

The III also reminds consumers of a need for auto insurance coverage with the risk of damage from earthquakes. If a car or other motor vehicle is harmed during a quake, your Comprehensive Insurance Policy would help you get it repaired or replaced, and back on the road.

Do You Really Need Earthquake Insurance?

Ask yourself:

- Do you truly need earthquake coverage?

- If so, how much will it cost?

Then, ask yourself these questions in order to determine whether it makes good sense to pick up earthquake insurance.

- Can you afford to fix or rebuild your house if it is damaged?

- Can you afford to replace your personal items in the event of a total loss or damaged to the point where you cannot use them?

- If your home’s structure is damaged and uninhabitable are you able to afford temporary living arrangements and other costs?

How Much Does it Cost?

Prices for earthquake insurance range quite a bit depending on where you live.

In Florida, you will be paying much less than a Californian, yet it isn’t too farfetched to suggest this add-on. Earthquakes do happen everywhere. The U.S. Geological Survey reports that 42 states are considered at risk, and 200,000 quakes take place annually nationwide.

In fact, several Florida insurance agencies like Dick, Johnson, and Jefferson and Norton Insurance offer earthquake coverage and populate in Search Results for this very product. So does FLINSCO.com.

What Does Earthquake Insurance Cover and How Does it Work?

Earthquake Insurance coverage pays for damages from quakes to your home and belongings. One portion of the coverage pays for damages to the foundation of your dwelling, the structure. The other part pays for damaged items like furniture and electronics under personal property claims.

An example of a homeowners earthquake claim is as follows:

Earthquake Coverage Limit $100,000.

Deductible of 15 percent.

Claim Submitted: $150,000.

Homeowners Responsibility is 15 percent of the $150,000 claim: $22,500.

Remaining Claim Balance: $150,000 Coverage Limit less the $22,500 deductible = $127,500

Insurance Plan Covers Dollar for Dollar, Up to the $100,000 Limit.

Unpaid claim and homeowner’s responsibility: $150,000 claim – $100,000 Insurance Plan payout = $50,000.

Resources

NAIC: Earthquake Insurance

Value Penguin: Earthquake Insurance Explained

USAA: Fault Lines: Do I Need Earthquake Insurance?

References:

- Cohen, H. (2019, April 17). Earthquakes are shaking the Florida border, and that’s a mystery even to the experts. Retrieved from https://www.miamiherald.com/news/local/environment/article229337059.html

- WESH 2 News. (2019, April 15). 9th Earthquake Strikes Near Florida-Alabama State Line. Retrieved from https://www.wesh.com/article/9th-earthquake-strikes-near-florida-alabama-state-line/27151434

- On Your Side Staff. (2019, March 7). Rare 2.6 Earthquake Shakes Part of Florida. Retrieved from https://www.wfla.com/news/florida/rare-2-6-earthquake-shakes-part-of-florida.

- Insurance Information Institute. Earthquake Insurance for Homeowners. Retrieved from https://www.iii.org/article/earthquake-insurance-for-homeowners.

- ValuePenguin.com. Earthquake Insurance Explained. Retrieved from https://www.valuepenguin.com/earthquake-insurance.