Florida prepares to go underwater. Flood risk projections show coverage and buying transparency are vital.

$413 Billion in Property Loss Projected from Flooding in Florida.

Homeowners Need to Know the Risk, and Insure Accordingly.

Florida is sinking. Climate change is inevitably showing its colors in the state each hurricane season and even year-round. Florida homes are most subject to destruction from rising seas than any other U.S. state. The value of homes and real estate will be sinking also as a result, according to a U.S. Coastal Real Estate Study.

Flood History Requirements Needed

With devastation from severe tropical weather and chronic flooding along the coast, it has never been more important to provide homebuyers with flood histories. Guy McClurkan of the Federal Association for Insurance Reform offered an opinion piece in response to the uptick in flood damage, stating that Florida sellers and landlords should be pressured by state laws to offer full disclosure regarding flood risk.

“When a family in Florida decides to buy or rent a home, they should feel confident they have the resources and power needed to make informed decisions and get truthful answers.

Today, that’s not the case. Sellers and landlords have no statutory obligation to inform a would-be buyer or renter of a home’s flood history or the flood hazard associated with the property,” says McClurkan.

PEW Trusts.org also asserts that more legal criteria surrounding flood risk disclosure for homebuyers is urgently needed.

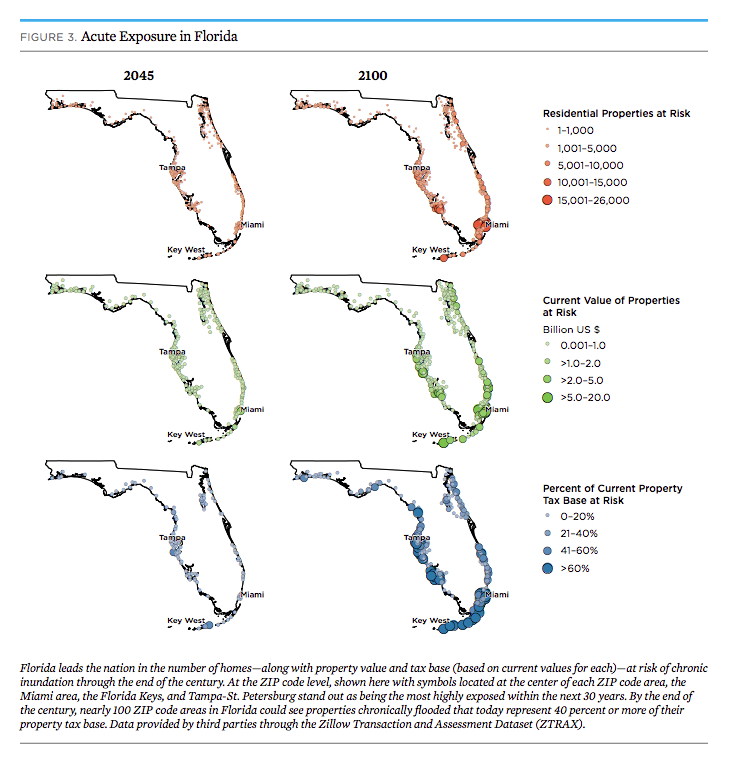

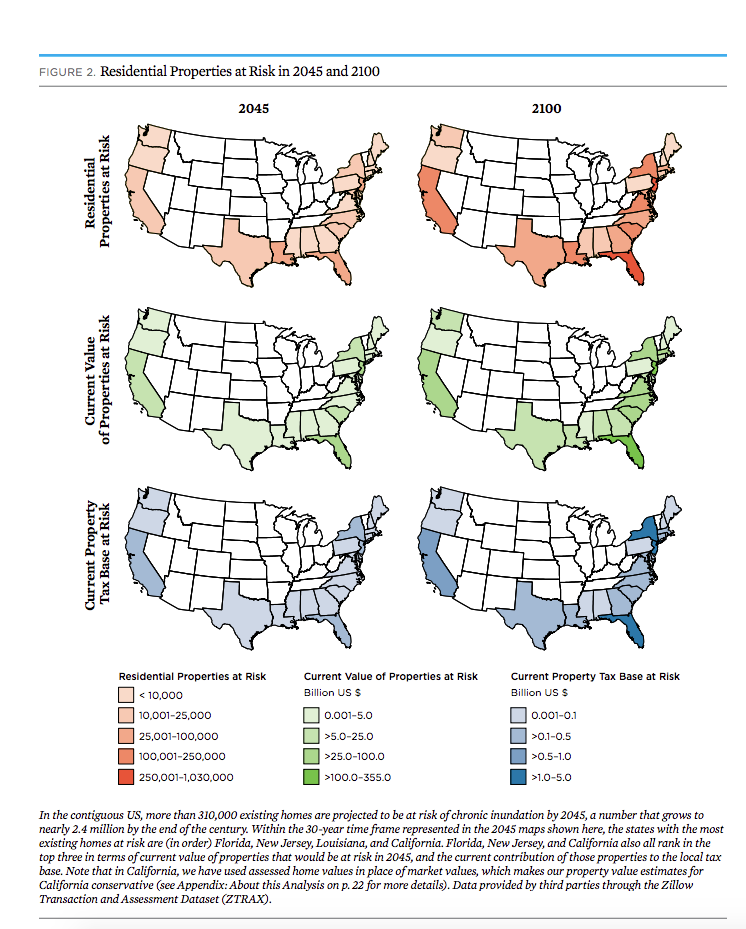

The study finds that by the end of the 21st century, almost 2.5 million residential properties, worth 1.07 trillion today, will be at risk of chronic flooding nationwide. In Florida, homes at risk of sea level rise inflates to a projected 1 million by 2100. Over 12,000 of those homes are in Miami Beach. Despite the risk and widespread knowledge of future issues, large scale condominium high rises are still being built throughout coastal Florida.

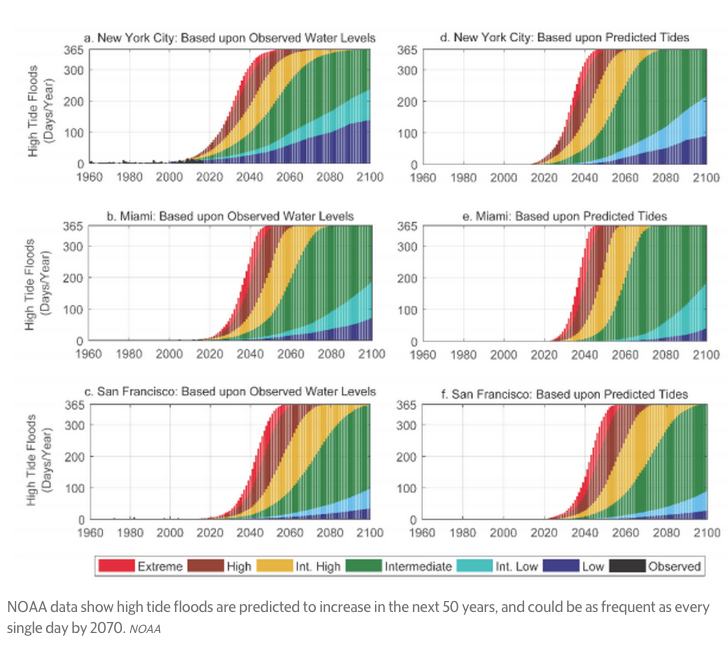

By 2045, nearly 64,000 Florida homes are subject to biweekly flooding, and half of those properties are located in South Florida. The National Oceanic and Atmospheric Administration (NOAA) projects that Miami could flood on a daily basis by 2070, according to various climate models. This estimate doesn’t even include King Tides, the highest tides of the year.

High tide floods are increasing fastest along the Southeast Atlantic Coast, says NOAA. Six feet of sea rise by the end of the century was projected in addition to these staggering figures by the Union of Concerned Scientists. The Union pulled data from Zillow and NOAA flood models.

Contiguous United States Projected Flood Risk

Florida’s Projected Flood Risk

Florida Goes Atlantian by 2100

“Well before homes go under water we’ll start to see chronic inundation that affects home value,” says Rachel Cleetus, one of the report’s co-authors. As floods occur more often, and grow stronger, their impact reduces the value of coastal Florida houses. Homeowners may decide that it’s less complicated to abandon their properties to foreclosure, instead of paying a mortgage exceeding their home’s actual value.

“Real estate is a huge economic driver [in Florida],” says Laura Geselbracht, a senior marine scientist with the Nature Conservancy, said. “And it’s at risk from sea level rise. People don’t want to believe it. That’s a normal human condition – suspension of belief.

“If you’re not a millionaire and you own a property in a vulnerable area, it may be a wise decision to think about moving before the masses think about moving,” Geselbracht said. She also owns a waterfront home in Fort Lauderdale, on the canal. While she strives for community connection in her neighborhood and city, she has informed her young one that it will be a different place when they grow up.

The Guardian’s Megan Mayhew Bergman cited the Union of Concerned Scientists study, noting that Florida is experiencing a climate change-induced real estate crisis, as are other Southern states. It is likely to have a brutal impact on those who can’t afford new insurance coverage, relocation, lowered property values, or support systems such as private sea walls.

Our fractured environment and its rising oceans will hit homeowners living in flood zones or near over-heated superfund sites and toxic factories. Homeowners who can’t afford to pay taxes on submerged land where they can no longer make a home will also be impacted.

Flood Insurance is an essential part of your homeowners policy in Florida.

Protection from severe weather and unavoidable, geographical shifts due to sea rise is a must for every Florida property investment.

Talk to a licensed FLINSCO.com agent to discuss your options and rates for flood insurance at your home address.

Need Flood Quotes? Call the FLINSCO.com Home Insurance Department: 800.218.0250

Own a small business in Florida? Contact our Commercial Department: 888.668.8398

Resources:

Flood and Home Insurance Quotes

FEMA Flood Map Lookup

U.S. Coastal Real Estate Underwater Report

References:

- McClurkan, Guy. Sun Sentinel. (14 August 2019). Retrieved from https://www.insurancejournal.com/news/southeast/2019/08/14/535443.htm

- Harris, Alex. Miami Herald. (30 March 2018). Retreived from https://www.miamiherald.com/news/local/environment/article207511429.html

- Mayhew Bergman, Megan. The Guardian. (15 February 2019). Retrieved from https://www.theguardian.com/environment/2019/feb/15/florida-climate-change-coastal-real-estate-rising-seas