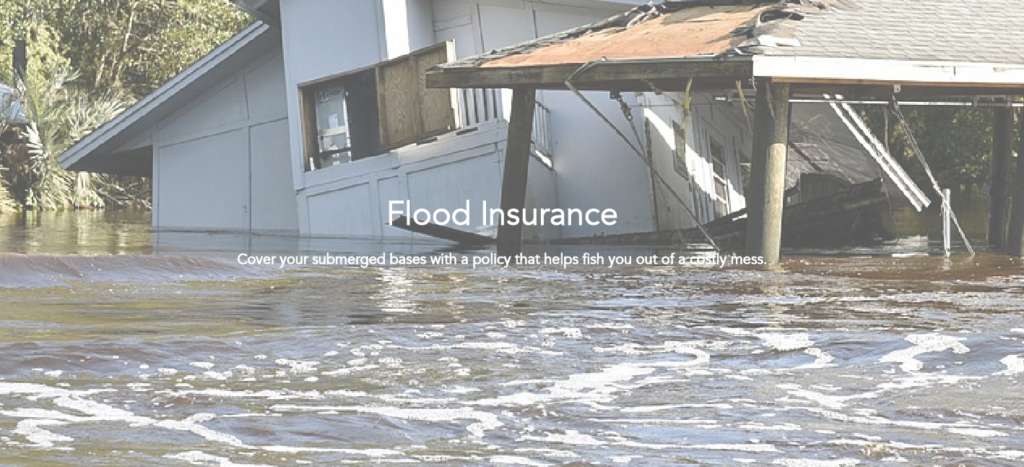

Flood Insurance

What Does Flood Insurance Cover?

Flood insurance policies are separate from the basic HO3 Homeowners Insurance policy you have on your home and valuables. Flood coverage will kick in to help pay for damages caused by rising water in your home.

The right insurer will help waterproof your assets by offering expanded, optional coverage that offers necessary protection during those times when high tide is suddenly in your living room.

25% of all flood claims are located outside of High Risk A and V flood zones. With most of Florida, and much of Georgia, in the line of major flood damage proximity due to dense coastal populations and a very large chance of rising tide, flood insurance is essential.

Standard Flood Insurance Coverages

While it may sound just like your existing Homeowners Insurance Policy, the Structures and Contents coverage provided by a Flood Insurance plan does vary from the HO3. Firstly, your HO3 policy will not cover flooding with most carriers. A separate flood insurance plan is required to pay for claims related to rising water.

Homeowners Insurance plans will actually exclude rising water damage specifically, in order to make it clear which coverage is which. Water damage is covered, yet “rising water” (i.e. flooding) is not. Insurance companies distinguish terms and file claims according to the “rising” water definition of flood damage being separate from other soggy matters.

Building Coverage

The insurance on the primary home/building on the property you are insuring.

Personal Contents Coverage

Personal contents coverage protects the possessions inside of your home.

Why Private Flood Programs?

Most flood insurance coverage in the country is written by the National Flood Insurance Program (NFIP). This program was established by Congress in 1968, giving homeowners, renters, and business owners in participating areas access to Flood Insurance.

However, NFIP is set to expire after the current extension runs out. Recent legislation raised the NFIP rates to help offset the $24B deficit of the NFIP. The law also made it a requirement to study the results of expanding private flood coverage options. Private insurers are also making efforts to create alternatives to this government program for their customer base.

Flood Insurance Examples

A good flood insurance company will help protect you and your property, even for an item not covered by the National Flood Insurance Program’s list. Coverage may be offered for the contents of your basement, detached structures like pool houses, garages, sheds, pools, as well as your home and its contents.

Basement Contents Coverage

NFIP only covers limited basement contents, including wall fixtures, elevators, washers and dryers, and air conditioners. Policy limits often go up to $10,000.

Pool Repair and Refill

Swimming pool related coverage is excluded specifically by the NFIP. With a pool repair and refill endorsement, your insurer will cover the cost to fix these items after damage from a flood. Coverage limits are typically $10,000.

Additional Buildings on Property

Detached structures excluded from NFIP coverage should still have their own section of your policy, especially for rising water damage. Cover your garage, shed, deck, and other unattached structures and their contents up to $50,000 in most cases with a special endorsement.

Temporary Living Expenses

Always an important add-on, making sure you’re able to stay in a safe, livable environment while your home is being repaired, this coverage pays for reasonable accommodations.

Get a quote for your home, property, and valuables from our licensed experts.

Call 800.218.0250 or email home@flinsco.com to get started.

References:

“Flood Insurance Coverage.” Neptune Flood, 1 July 2019, neptuneflood.com/flood-insurance-coverage/.